Cashback has become one of the most attractive rewards in modern-day digital payments. Whether you pay through a credit card, debit card, UPI app, or digital wallet, cash back offers promise instant savings or rewards after a transaction. Ever wondered how banks and wallets are able to give cashback in the first place? Is that free money, a marketing trick, or a carefully designed financial model?

In this article, we try to break down how cash back really works, at whose expense, why it’s being offered by banks and wallets, and the sustainability of such offers. This is purely an information guide that will help you understand the system that works behind getting cashback rewards.

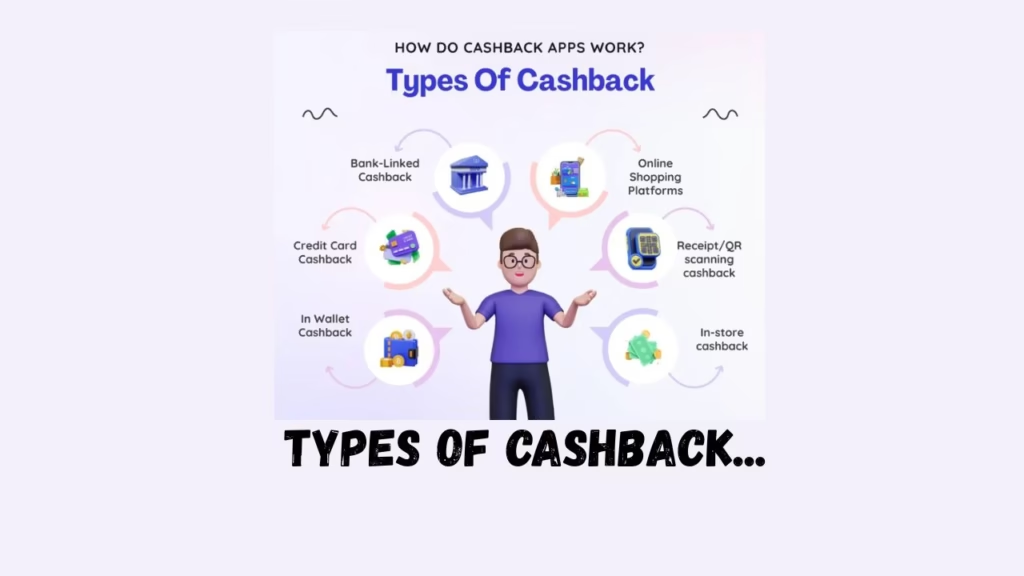

What Are Cashback & Why Are They Popular In India?

Cashback basically is a kind of reward that returns part of your spending to you in cash, wallet balance, statement credit, or as reward points convertible to money or vouchers. Unlike discounts applied before the payment, cash back usually comes after the transaction is completed.

Cashback rewards are in demand because of:

- It’s like real money that’s been saved.

- It’s easy to understand compared to complex reward points.

- It encourages repeated usage of a card/app.

For the customer, rewards of cash back seem like a very positive gain. For the bank and the wallet itself, this is a very effective technique.

The Core Funding Source: Merchant Discount Rate (MDR)

Cash back services have, therefore, started receiving revenue through the Merchant Discount Rate (MDR). This is the fee that the merchant has to pay with every digital payment that you make.

The cost is shared by:

- Bank that has released your card or the UPI handle.

- “The payment network”.

- The acquiring bank or payment processor.

Out of this, banks and wallet providers allocate a certain amount towards funding the rewards.

Example:

For example, if the merchant has to pay ~1–2% as MDR on the transaction, then the bank or wallet might refund 0.5–1% to the user as “cash back” and retain the rest as income.

That is why cash back rewards are more frequent in card transactions and online payment transactions compared to offline transactions, especially those that have low margins.

The Way Banks Organize Cash-Back Rewards for Credit & Debit Cards

Cashback is one of the incentives adopted by banks to promote card usage and customer retention. The higher your transactions, the more the bank makes money from transaction charges.

Banks commonly organize cash back as follows:

- Flat cash back on all transactions.

- Higher cash back rewards on certain categories (clothing, dining, gas).

- Cap on the cash back received every month or billing cycle.

- Conditional Cashback (With Minimum Required Purchase).

Cashback, in many instances, isn’t always free; rather, it’s offset by:

- Annual or joining fees.

- Interests earned from users who are not paying their bills in full.

- Breakage (customers who do not redeem cash back or rewards).

Thus, the banks can both provide the customer with cash back and achieve profitability at the same time through.

Cashback Offers by Digital Wallets & UPI Apps

Wallets and UPI apps function differently compared to conventional banking. There could be cases, especially during the growth phase of wallets, which give cash back to consumers as an acquiring cost as opposed to revenue sharing.

Wallet cashback is supported by:

- Venture capital and the marketing budget.

- Merchant Partnerships & Brand Promotion.

- Providing cross-sell services of financial products like (loans, insurance, investments).

In the initial phases, the wallet can even be in the red, with the cash back system used for building a large customer base. Over time, with the users becoming habitual, the cash back deals can be minimized.

UPI cashback, especially, can be:

- Sponsored by banks or merchants.

- Timing: Limited time/event-based.

- Subjected to daily and/or monthly limits.

This is why UPI cashback deals keep changing every now and then, and once the usage patterns become steady, the deals vanish.

Merchant & Brand Sponsored Cashback

However, cashback offers are not always from banks or money wallets. Brands and merchants also sponsor cash back offers so that they can boost their sales.

For Example:

- An “A” brand creates funds for cash back rewards for the purpose of promoting a new.

- A merchant provides cash back services to encourage frequent sales.

- E-commerce platforms contribute towards subsidies of the cash back when there.

In these situations, cash back is kind of a marketing cost, whereby the idea is to boost exposure, conversions, and retention, but not directly maximize profits.

Why Cashback Always Comes With Limits & Conditions

Very few cashbacks are unlimited-and understandably so. Banks and wallets keep their costs in check by adding conditions like:

- Maximum cashback caps.

- Category restrictions.

- Minimum of transaction value.

- The point with limited validity period.

These rules help to ensure cashback:

- Encourages usage without creating heavy losses.

- Targets the specific behavior of users.

- Remains financially viable.

That is also why high cash back rates are usually temporary or promotional.

Cashback vs Discounts: Key Differences

| Aspect | Cashback | Discount |

|---|---|---|

| Paid when | After the payment | Prior to the payment |

| Funding source | Bank / wallet / merchant | Merchant |

| User perception | returned money | upfront saved money |

| Flexibility | Usually capped | Usually fixed |

| Marketing effect | Will promote repeated usage | Will promote instant consumption |

Both models exist to influence buying behaviour, but cash back is significantly more effective for long-term engagement.

Is Cashback Sustainable in the Long Run?

Cashback is only sustainable when balanced correctly.

When a platform achieves:

- High transaction volume.

- Strong customer loyalty.

- Diversified revenues.

Cashback is reduced, refined or replaced with:

- Tier-based rewards.

- Partner benefits.

- Subscription-based benefits.

This is why early adopters tend to have better cash back as compared to the ones who stay longer.

Final Thoughts: Cashback Is a Strategy, Not Free Money

Bank cash back rewards aren’t simply kindness nor random gifts—it’s an intentional financial move. The revenue sources come from transaction fees, partnerships, interest, and marketing budgets, all of which target your spending behavior.

For the consumer, the knowledge of how cash back transactions take place is important because,

- Selecting improved methods for payment.

- Resisting Misleading Offers.

- Financial Decision Making.

When done correctly, the cash back accrual is a true benefit. However, comprehension of the underlying system in place allows you to maximize rewards without accumulating unnecessary expenses.

For More Information You Can Visit our Page

Frequently Asked Questions (FAQs)

Is cashback really free money?

No. Cashback schemes get the money from transaction fees and business deals and advertising expenditures.

Why do cashback offers come with limits and conditions?

Banks and wallets use limits to manage their expenses but also keep their cashback schemes going on for long term.

Why is the cashback greater on credit cards than cash payments?

Digital payment systems create transaction fees which banks use to provide cashback rewards.

Why do UPI & Wallet cashback offers are not constant?

They are often promotional, time-limited, and adjusted based on usage patterns.